The Current State of Investing — A Very Skeptical Introduction

The Current State of Investing — A Very Skeptical Introduction

“Why?” This is probably the most common word that I use day to day in my whole vocabulary. I think anyone that knows me well enough would agree. I love to ask questions, always follow up for answers, and then of course, ask the question “why?” again. As time goes on it is quite obvious that everything in the world from social norms to technology to multinational economics, and you name it…grows in complexity. As human curiosity and development seem to evolve exponentially, it gets harder and harder to always keep up.

Now, keeping up to me means more than just reading headlines that reassure your natural tendencies and preconceived values, keeping up means doing enough digging to ensure you understand multiple perspectives on an issue so that you can make an informed and unbiased conclusion. That’s why I always emphasize curiosity and the desire to never stop asking questions. This will be a recurring theme that you’ll see in anything I write, from this blog to every subsequent blog afterwards. After all, I really think wholeheartedly that the best skill anyone can possess is the ability to always have an open-minded way of thinking, which of course…leads to lots of questions.

With this blog being the first, I just wanted to do an introduction on the current state of affairs for the investing landscape. I don’t want to get into too many nitty-gritty details here about any one particular subject, as I do want to revisit many of the things I will touch on here with more in-depth analysis and opinion in later blogs. This will provide an overview of several significant variables that unfortunately play a large role in dictating short and long-term trends in the financial markets.

A Huge Change in Methodology:

Gone are the days of investing being easy… let me start with that. Way back 40+ years ago, any everyday person used to be able to pick almost any stock off of a developed nation’s exchange and expect a positive return in the end. Especially if the company actually had strong and consistent numbers in the financial statements, and was a well-known name brand company, you could count on that sucker to go up eventually. You could follow a lot of Ben Graham’s old value investing principles, which were largely just enhanced stock screening guidelines, and you’d be fine. If you kept your emotions and knee-jerk reactions in check, you’d be fine. You could even get away with not following industry-specific and global economic developments. Change and technology weren’t as drastic back then, which made things a lot more predictable, and so your tried-and-true investing philosophies worked, and never had to change either. Well gone are these days, change is always rampant, information is always at our fingertips or just a simple Google search away, and our national economies are now more globally intertwined than ever before. Understanding global macroeconomic developments along with shifts in social trends and the psychology of the consumer is now just as important if not more important than analyzing a specific company’s financial data from the bottom up.

To clarify, I actually used to closely follow Graham’s (and Buffett’s) ways, it’s how I started, I read the Intelligent Investor when I was 14 years old. It changed everything for me, and I have been an avid value investor ever since. The Mr. Market analogy about misbehaving markets where people overreact to everything and often misprice companies based on pure emotional motivation rather than rational reasoning is timeless and invaluable knowledge that will hold true as long as our markets exist.

But…the idea that you can find undervalued companies, buy them, and just hold and let your investments prosper for decades is becoming harder to execute. 2008 showed us that real estate stability isn’t forever. The current caving of many brick and mortar retail outlets like Macy’s and Sears shows us that perhaps changing age pyramids and demographics can redefine product demands and trends become harder for companies to stay on top of. Industries change faster than ever before, and the time it takes to stay dedicated and informed is very demanding. So perhaps it is not feasible to just buy an undervalued company and look away for 5 years.

There are many other criticisms I could give about existing investing and finance theory. I don’t think volatility defines risk. I also don’t think that having increased information more readily available at our fingertips makes the market more efficient, I think it just makes it more reactive and prone to even further miscalculations of up and down pricings. I could go on and on, but ultimately these topics are up to you as an individual to interpret and debate. The point I ultimately try to make here is you need to use the tools and timeless knowledge of the past as a base, but your investing philosophy needs to be evolved into your own style to match your fundamental beliefs and interpretations of the sustainable future.

The Elephant in the Room:

Alright, now let’s get this over with here, time for a bit of a change in tone to this blog. I hate to do it, really, because he already gets far too much attention than he deserves. Unfortunately though, his presence, his potential policy and his psychological war of words has real world affects that often seem to impact financial markets with huge relevance. This man of course is President Donald J. Trump.

I remember in the months leading up to the election, we were lead to believe that electing Hillary Clinton was the only way that the American economy could be held up positively. If Trump was elected, all the stock market indices were expected to tank, and the counteracting assets like precious metals were supposed to skyrocket as a safe haven. Almost every major media outlet played this narrative, CNBC, BNN and all their analysts were all saying the same thing. When it became clear that Trump was likely to win on election night, the markets reacted in line with what was expected. Dow futures were down as much as 800 points and gold spiked 5% over $1,335 an ounce at its peak.

However, after what seemed like a calm victory speech, it was apparently good enough reason for investors to celebrate immediately the next day as if Clinton got elected. The narratives did a total 180, and every analyst that was in favour of Clinton suddenly became a Trump fan, and came up with plenty of reasons why we should be optimistic of the Trump administration. The markets of course, followed suit. Since the November 8th, 2016 election night, we have seen the Dow Jones Industrial Average rise from 18,000 to a recent high of over 26,600. Recently we have seen some volatility and corrections to bring the index to hover around 25,000. Roughly a 40% gain in a little over 15 months…seems highly optimistic.

To which I say, what was and is there to be optimistic about? I understand that people wanted a non-politician, a change in the White House, but Trump is far from the ideal person for that role. I’ve been saying for the longest time that the worst thing about Trump isn’t the racism and petty attacks on others, it’s his incompetence. Ironically though, perhaps this has worked to our advantage in many ways as he can’t seem to get anything passed into law. Try finding 1 significant legislative win he’s had, something other than an executive order or the Republican tax bill which was a layup to pass, and I guarantee you will start pulling your hair out.

A president that spends hours a day watching television and tweeting outrages at critics, meanwhile according to close aides refuses to read adequate briefings and instead only wants to read one page filled with pictures, is not someone who has the attention span to handle critical decisions in the White House. There are fun sites out there like http://trumpgolfcount.com/ that try to keep a reasonable eye on his productivity for us as well. It is one thing to be a rude individual with an obviously self-absorbed personality, but it’s another thing to not show interest in or perform your job properly, especially when you have the most important job in the country.

What else are we seeing with this administration? Trump was supposed to be the inflation president, focusing on protectionism and an America-first inward economics strategy. In my opinion, 50+ years ago this frame of thinking may have been feasible, but nowadays it is just isolating the country from participating in an innovative global economy with forward thinking investments in areas of growth such as renewable energy. We get an EPA stripped of all of its influence and a Consumer Protection Bureau currently being dismantled. A cabinet decorated with ex Goldman Sachs employees, namely Steve Mnuchin as Treasury Secretary and Gary Cohn as Chief Economic Advisor. And of course, plenty of advocation for deregulation.

Now personally, I’m on board with getting rid of any regulation that causes inefficiencies in progress or a total loss of a free market. However, we do need regulation to protect consumers and also the environment from predatory practices. We can’t have nothing, what would be the purpose of society then? Anarchy cannot be embraced, and surely over time oligopolies and monopolies would take over so much business that the best elements of a free market are lost anyways. Especially when it comes to the banking industry, we can’t have the Dodd-Frank act or any more of the Glass-Steagall legislation repealed. History has shown us several times that undoing such regulatory progress leads to temporary gains but ultimately even bigger losses when out of control derivatives and lending goes wrong. You can call some bankers and brokers greedy, but ultimately people will be people, it’s more of a systematic issue that gave them the incentive in the first place, and that is what we can’t allow into law. But, I’m almost certain we will see it happen again, so just try to remember this quote:

“Insanity is doing the same thing over and over again and expecting different results” — Albert Einstein

With all things considered, you’d think market participants would be a bit more cautious in exercising judgment. But alas…the market doesn’t seem to care. The consumer confidence index is still on the rise, so I guess the party just must go on. Even though Trump himself on the campaign trail said that the market was “one big, fat, ugly bubble”, so what’s different now? He seems to love the direction that the markets are going, regardless of any underlying data. Perhaps it’s inconvenient because he feels it’s now partially his responsibility, it’s now his “big, fat, ugly bubble” that he doesn’t want to own. Regardless though, I think it is important to note that the responsibility of the value of the stock market does not fall on any one individual, although the market seems to forget this sometimes. Most market factors are outside of the president’s control and any major policy-driven influence that can be made takes years to see full implementation in effect. With the lack of legislative progress that we’ve seen so far though, it is likely we are still largely in Obama-era economics and progress (if you even want to call it that).

Central Banks, Debt and Interest Rates:

Central banks all across the world have not had an easy job for the last 10 years. Following the great recession in 2008, almost all major central banks including the U.S. Federal Reserve, the European Central Bank, the Bank of Canada and the Bank of Japan participated in a stimulus plan of low interest rates and asset purchase programs via government bonds. This low interest rate environment and increased money supply was supposed to stimulate growth. Since the recession, we’ve seen 1–3% gains in annual GDP for most of the western world. This is at least some level of growth, but mediocre at best considering that federal fund rates were kept below 1% for almost 9 years.

In my opinion, central banks have kept at it too long with this strategy. This shortsightedness only provides band-aids to problems, not productive long-term solutions with lasting value. Do they really think that debt-fueled growth is the answer? What happens when the average person or small business sees low interest rates lasting for years? Human behavior would tell us that most people would think that’s the new normal, and perhaps feel free to load up on debt thinking there are little consequences. When rates rise naturally in the long run, suddenly people are left paying huge interest on debt that may even outweigh any equity.

Central banks kicked the can down the road and played economic hot potato long enough, and this is now the situation we have. As central banks have begun to modestly raise their target rates in 2017, and intend to continue to do so “carefully” in the short term, we can only cross our fingers that bubbles aren’t pricked. This way of finance is unsustainable, and the only true path to growth is for companies to organically invest time, effort and money into things like innovation, efficiency, technology, transparency through social media, employee satisfaction and incentivized compensation.

GDP and jobs are always the focus of the market, with most market participants not reading past headlines and seeing what else is behind the numbers. Personally, I like to look at dozens of different figures, but let’s keep it simple here. Sure, it’s nice to see unemployment at very low levels recently, but it’s not nice to see labour force participation dropping and employee wages in the U.S. remaining stagnant. As mentioned before, GDP has been growing roughly 1–3% annually since the last recession, but what about the associated debt that has been behind that?

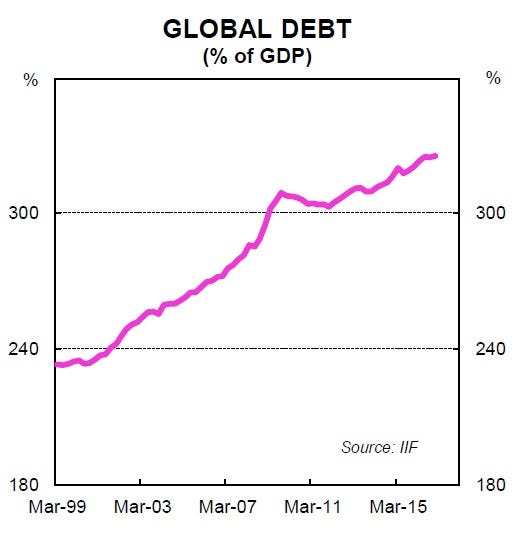

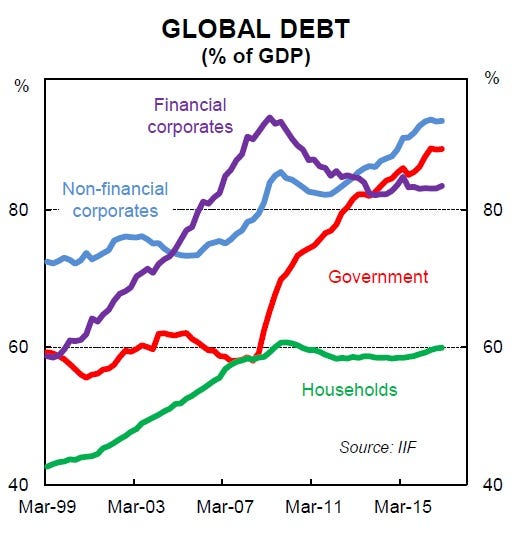

See below. For the record, finding reliable global debt figures including a detailed breakdown is extremely difficult, even searching through the World Bank and IIF websites yield few historical and comparative results, it’s almost like they are trying to hide something. Big credit to Business Insider here for having the guts to even put these charts in one of their articles, and piecing together what are seemingly elusive figures from the IIF, as simple as they are. Note that the numbers on the Y-axis denote trillions of USD.

Well, it seems that debt growth continues to outpace GDP growth in key areas consistently, which to me is not a pleasant sign of a sustainable ecosystem of growth. Now this is a very simple comparison of debt to GDP on a global basis, and deserves a much more in-depth breakdown, but I will save the huge debt discussion for another time. For now, I will let you glare at those charts as you will, and interpret them for yourself.

In Canada there seems to be a particular problem with debt, as the simplified debt to household income ratio keeps rising at all-time highs, and now sits at 171%. Perhaps the lack of a real estate market correction for decades has got people excited about buying homes and expecting big returns. Maybe it’s the mortgage rates a few years ago hitting all-time lows of 2.99%, or the dozens of credit card interest rate discounts and incentives for new customers. The U.S. seems to have an increasing income inequality problem, as evident by the rising Gini coefficient. Americans work longer hours and for smaller wages, and can’t afford much spending out of their own pocket. Student debt is higher than ever, especially for Americans sitting at now $1.48 trillion in total student loan debt. Jobs are more competitive upon graduation, making millennial participation in the economy limited, especially in discretionary spending categories. This just adds more debt, rather than real organic growth and spending via earned income.

Despite all their efforts, the enormous US government debt continues to grow. Corruption and irresponsible spending have led to shortsighted decisions that benefit only the establishment in power, and leave budget deficits for everyday Americans to inherit. In fact, the Trump administration is actually recently revealing what appears to be a $1 trillion budget deficit for the year 2018 if the bill is passed. This compares to post 2008 recession level deficits. This insane fiscal policy of spending is not sustainable, especially if we won’t be seeing major productivity increases from integral industries like manufacturing. The lower taxes on corporations would appear to be a benefit to them, but I can almost guarantee that most money saved will just be distributed to shareholders via dividends or stock buybacks. This is something we’ve seen a lot of lately as it is, and also falls under the umbrella of shortsightedness and financial engineering, not long-term sustainable solutions.

There are few people or entities that actually give objective and unbiased forecasts. Central banks, namely the U.S. Fed are no exception to bias. The Atlanta Fed always seems to start quarterly GDP estimates way higher than they should, then always revises them down gradually, but that’s how a narrative of optimism is created. Start with high estimates to get it in everyone’s head, then revise it down to reality when no one is paying attention, or, just call it a fluke. I challenge you to look for yourself, starting in 2017, they always began the quarter with roughly a 4% annualized GDP estimate, then slowly revised it down to the actual 2–3% range that it actually ended up being.

Unfortunately, it seems the Fed’s job has become that of an optimism spreader, whether warranted with actual reality or not. Every Fed meeting in recent memory has ended with Janet Yellen making a speech about how the economy is on track, everything is fine, and objectives are being reached. Name one instance where the federal reserve has accurately predicted a major economic downturn or recession. It’s hard to find any recent examples, but that’s okay, we’re led to believe these are the smartest people in finance with the best forecasts, and they wouldn’t ever hide anything from us.

Mainstream News, Human Psychology, and Closing Thoughts:

During the summer of 2017, an estimated 16–20 million people in East Africa experienced famine or were on the brink thereof. The United Nations humanitarian chief even said it was the worst humanitarian crisis they’ve faced since World War II.

I bet the majority of you reading this never knew that. That should be important news, but instead we get distracted by “covfefe” and Google’s broken burger emojis. It seems as a society, we often get caught up in petty first world drama and forget about real world priorities. This is why it’s important for all of us to be curious, open-minded, and look into facts ourselves, go far beyond what the media just won’t tell us, because they refuse to do their job properly anymore as it’s not profitable to do so. It’s only ever about the access, and the ratings.

Watch CNBC, BNN, Bloomberg, and you’ll see this constant optimism narrative. Optimism is easier for people to attach to, instead of realism, and hence this is what they sell. Why do you think they mistreat anyone that comes on their program that offers a different perspective, perhaps a more authority-questioning perspective. People such as Peter Schiff, James Rickards or Steve Eisman, will come onto a mainstream show and get criticized for some of the “outlandish” things they may say. Needless to say all three of those gentleman called the last recession before it happened in 2008. You would think that perhaps it’s important to learn from people like this. People who can share some important insight into how they saw what so few others could, and maybe given some teachable solutions, or thoughts on what is still to come. You may not agree with everything they say economically or politically, I sure don’t; but a little bit of open-mindedness can go a long way to understanding other perspectives, and maybe seeing something that you would have never thought of inside your own protected bubble of what you want the world to be. I want people to be more critical, and skeptical of the information they see. Important decisions depend on how we interpret information. This quote by Mark Twain says it best, “it ain’t what you don’t know that gets you into trouble, it’s what you know for sure, that just ain’t so.”

The market eventually comes to reality, even though it often takes far longer than it should, and it usually takes until the brink of crisis. Why do you think our economies behave in boom-bust cycles, rather than steady and conservative dips up and down based on the fundamental laws of supply and demand. Everyone has an agenda, and preconceived values and biases of what they want to see is reality, and it often doesn’t matter how many facts can be laid out against one’s case, most people will still stick to what they want to believe is real, not what is actually real. That’s human psychology at its core. It’s easy for people to emphasize any fact that’s convenient for their goals, but anything that’s inconvenient, anything that may rock the boat, they immediately categorize as just being negative, and far-fetched. Furthermore, anyone that emphasizes those inconvenient facts are immediately isolated and often discredited for not acting like the rest, for being “different”. If you’re not part of the club, your opinion is not welcome.

However, this willful ignorance and lack of open-mindedness is extremely dangerous. When people put blinders on and start hand waving to try and ignore what is inevitable, the reality eventually hits hard, and at that point the bust happens. Money starts flowing out at a rapid pace, and all the inflated prices crash down to often below where they even started. This pattern should be obvious, but to many, in the heat of the moment while they watch their investments flourish, forget all rationale and reality.

If a lot of politicians, central bankers, economists, news anchors and analysts out there don’t start doing their jobs right, the public will continue to lose trust. The market eventually catches on, and often forces a change if need be. We have to hold people accountable, but perhaps future technologies like the blockchain and a new paradigm of decentralization will help us do just that (I greatly look forward to discussing this topic).

This first post might have seemed a bit long, but I tried to touch on many issues. There will be many future posts extending some topics that I introduced here, as I feel many topics here need more detailed analysis and insight. I hope by reading all this you don’t feel too depressed. I’m not a pessimistic, negative person, I’m just a realist. I think it’s important to understand all sides of any argument, something I don’t think most people get to experience when it comes to these topics. Everything has an explanation, and while it’s great to see positive statistics, understand that the underlying reasons may not always be so positive also. Always ask the question “why?”, and don’t be afraid to say something bold that you have very good reason to believe in.

Now despite all these problems that exist, I am optimistic that there are many great things still trying to pull the world in the right direction. Although I am clearly arguing that markets are quite overvalued at the present time, and that you should tread carefully, there are many great opportunities that still exist. Renewable energy, blockchain technology and the odd product innovation here and there are still worth a look. All of which, I will talk more about in the future. But for now, just remember to stay informed, stay skeptical, and never stop asking questions.

Sources:

http://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?page=

https://www.frbatlanta.org/cqer/research/gdpnow.aspx

https://www.federalreserve.gov/monetarypolicy/quarterly-balance-sheet-developments-report.htm